Another month, another increase in both total savings and projected annual dividend earnings. Automated savings + compounding returns = a very powerful force. It of course doesn’t hurt that the overall markets continue their upward trajectory.

We did see a decrease in our cash savings, as we spent a few dollars on a home renovation project. This was an investment both in our own enjoyment of our home as well as something that will increase the overall value of the home. Win-win.5

Here are updated account numbers as of May 31, 2018

Formula = Savings x Yield = Annual Income

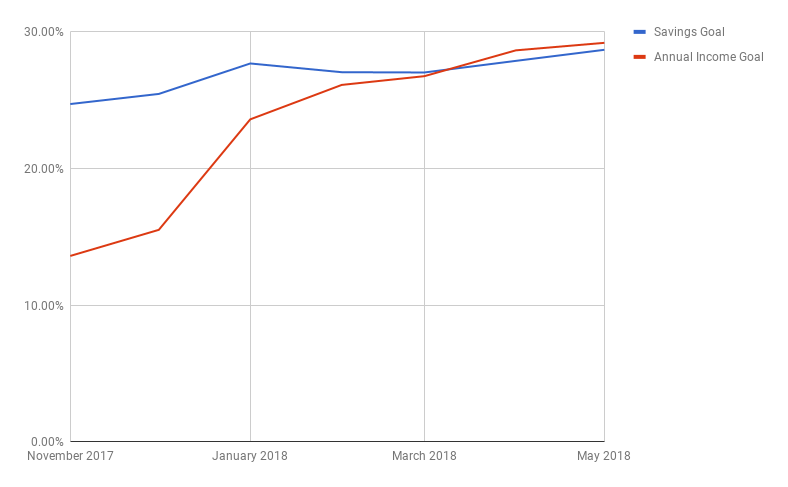

Savings: Total of all savings as a percentage of the total goal

Dividend Yield: Current yield of all tracked holdings (now including 401k’s!)

Annual Income: Expected dividends from all holdings as a percentage of the overall goal (now including 401k’s!)

On to the numbers!

Savings % = 28.69% (+0.81%)

Dividend Yield = 3.29%

Annual Income = 29.20% (+0.55%)

That’s a hefty dividend yield. Nice savings rate too